- Published on

When working harder for money is not worth it (Part 1)

- Authors

- Name

- Feanor RS

Introduction

I was playing with the idea of when working harder for more income stops being worth it. With progressive income tax systems like we have in Canada and many other countries, it's reasonable to ask when more effort simply isn't worth the extra money. This question has several dimensions to explore, so for this first article, we will focus on how taxation affects higher income earners.

Assumptions

- The simplest way to look at this problem is by assuming you have a straightforward job that pays you a salary. To simplify the explanation, I will omit dividends, business income, and capital gains.

- For modeling, I used Chat-GPT and provided it with all the tax brackets, basic personal exemptions, and other details. Honestly, Chat-GPT is not ideal for this type of complex modeling, so the calculations present a general picture rather than exact accuracy. I aimed to be within a 1% margin of error and verified the math using online tax calculators.

- I chose British Columbia (BC) as the province for this example for year 2024. Substituting the tax brackets for a different province should be simple enough. Note: BC has the lowest tax brackets compared to other provinces in Canada.

Results

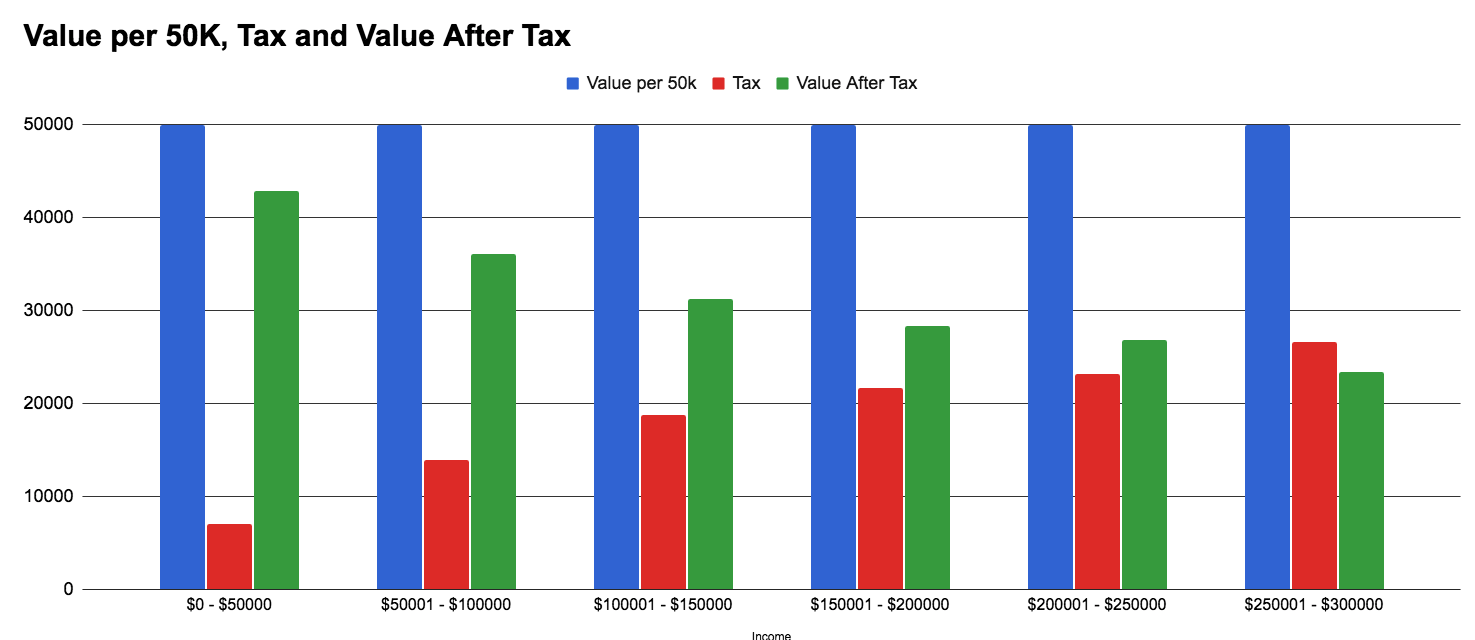

Nobody I met likes the complexity of tax brackets, so to simplify the picture, I split income into 50k incremental chunks. Note that income above 300k would be taxed the same as the column on the far right.

Wrap-Up:

Working harder does not necessarily translate to earning more money due to the progressive tax system, which significantly affects medium-income earners. Therefore, it is worth considering working smarter rather than harder and, in the meantime, searching for alternative income streams. Ideally, these alternative streams should have different tax treatments and not simply become another side job.

Pro Tip: If you are a high-income earner, feel free to take unpaid days off to supplement your vacation. The income loss is not as significant as it seems. Income on those days will be deducted against your marginal tax level, which is taxed the heaviest, but a day off is still a full day off.

Future Works

In the second chapter, we will revisit the topic and explore the career ceiling curve that lowers your income even further, often disproportionately to the stress and effort you might put into it.